National Mileage Reimbursement Rate 2024 Nc. 67 cents per mile driven for business use. Effective january 1, 2024, the office of state budget and management (osbm) increased the travel mileage reimbursement rate for official university business.

Any employee driving for work and using their own personal vehicle for work can claim 65.5. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Nc And Sc Mileage Reimbursement Rate Increases.

67 cents per mile driven for business use.

Change In Irs Mileage Rates Effective January 1, 2022.

Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

The Internal Revenue Service Has Increased The Reimbursement Rate For 2024 To 67 Cents, Up 1.5 Cents From 2023, When Using A Personal Vehicle For Business.

Images References :

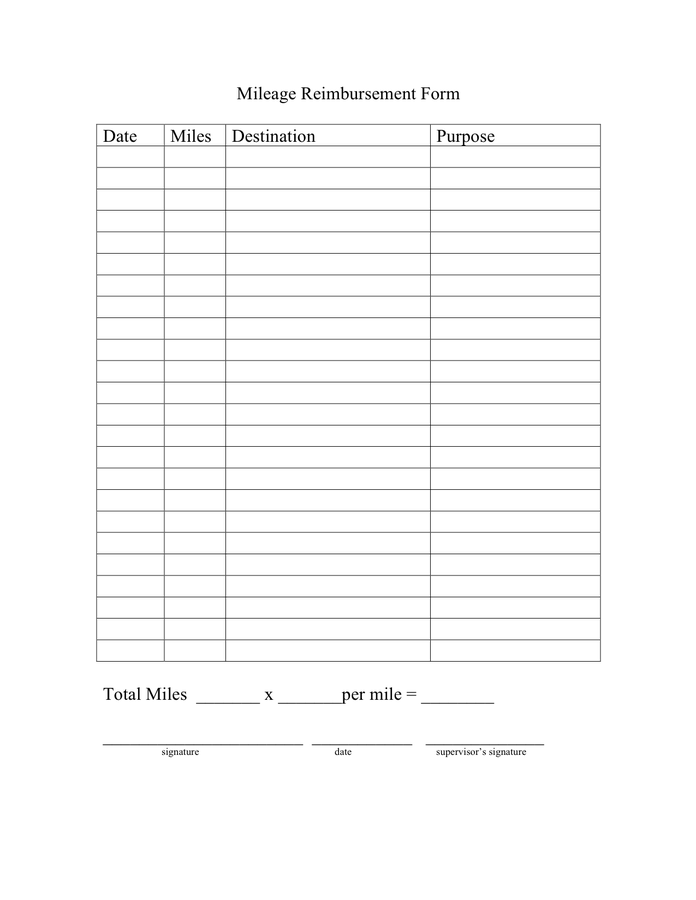

Source: jemmieqjaquelin.pages.dev

Source: jemmieqjaquelin.pages.dev

Rate Of Mileage Reimbursement 2024 Val Libbie, Change in irs mileage rates effective january 1, 2022. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Source: francescawcarena.pages.dev

Source: francescawcarena.pages.dev

Mileage Reimbursement Rates By Country 2024 Fayth Jennica, All business miles will be reimbursed at the irs standard business mileage rate, which is subject to change periodically (note that the rate changed, effective. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023.

Source: alejandrinawkora.pages.dev

Source: alejandrinawkora.pages.dev

2024 Car Mileage Reimbursement Rate Mandy Rozelle, Effective january 1, 2024, the office of state budget and management (osbm) increased the travel mileage reimbursement rate for official university business. All business miles will be reimbursed at the irs standard business mileage rate, which is subject to change periodically (note that the rate changed, effective.

Source: berthaqdiannne.pages.dev

Source: berthaqdiannne.pages.dev

Travel Reimbursement Rate 2024 Letti Olympia, 58.5 cents per mile for business miles. Nc and sc mileage reimbursement rate increases.

Source: www.efleets.com

Source: www.efleets.com

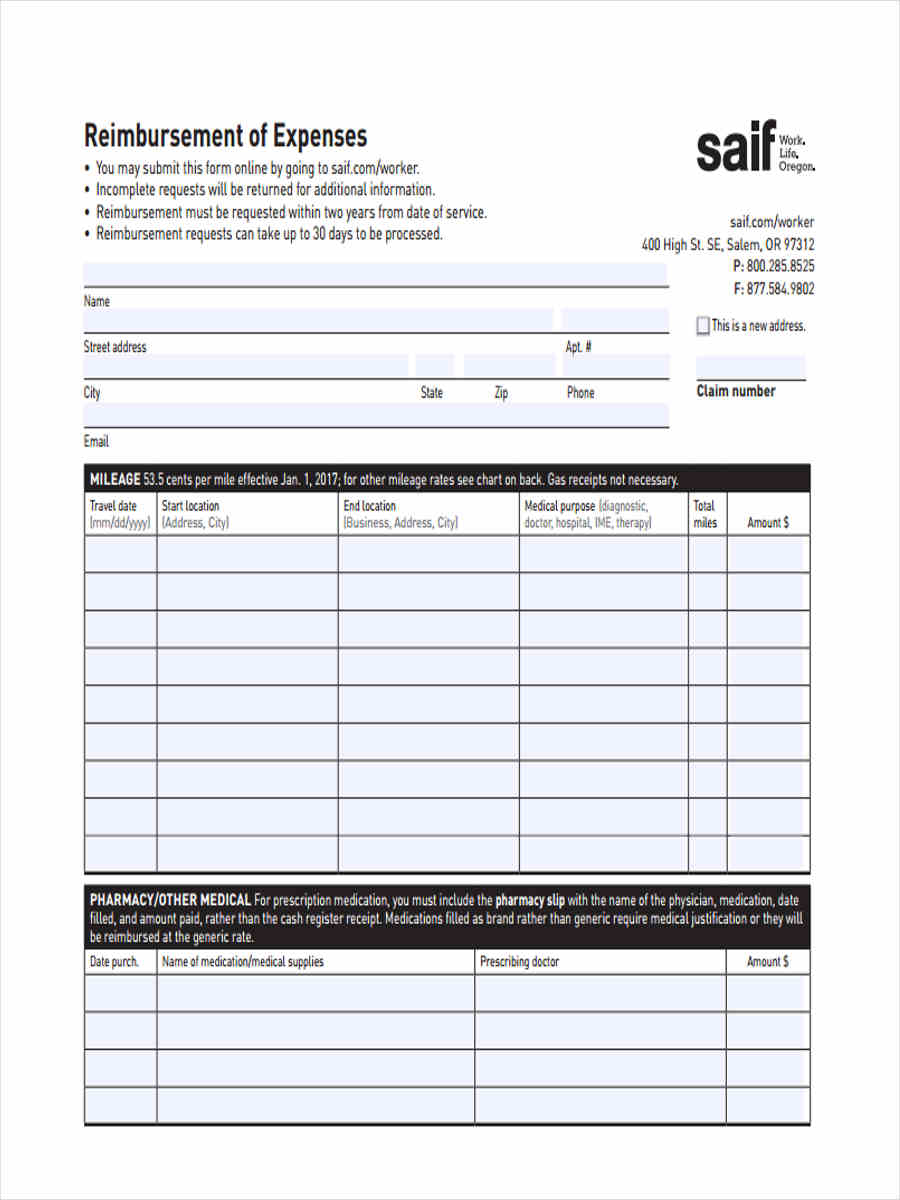

Fleet Management Services, Allowance, Reimbursement Enterprise Fleet, Effective january 1, 2022, the internal revenue service. Effective january 1, 2024, the standard mileage reimbursement rate for transportation expenses as set by the irs has increased to 67 cents per mile (up from.

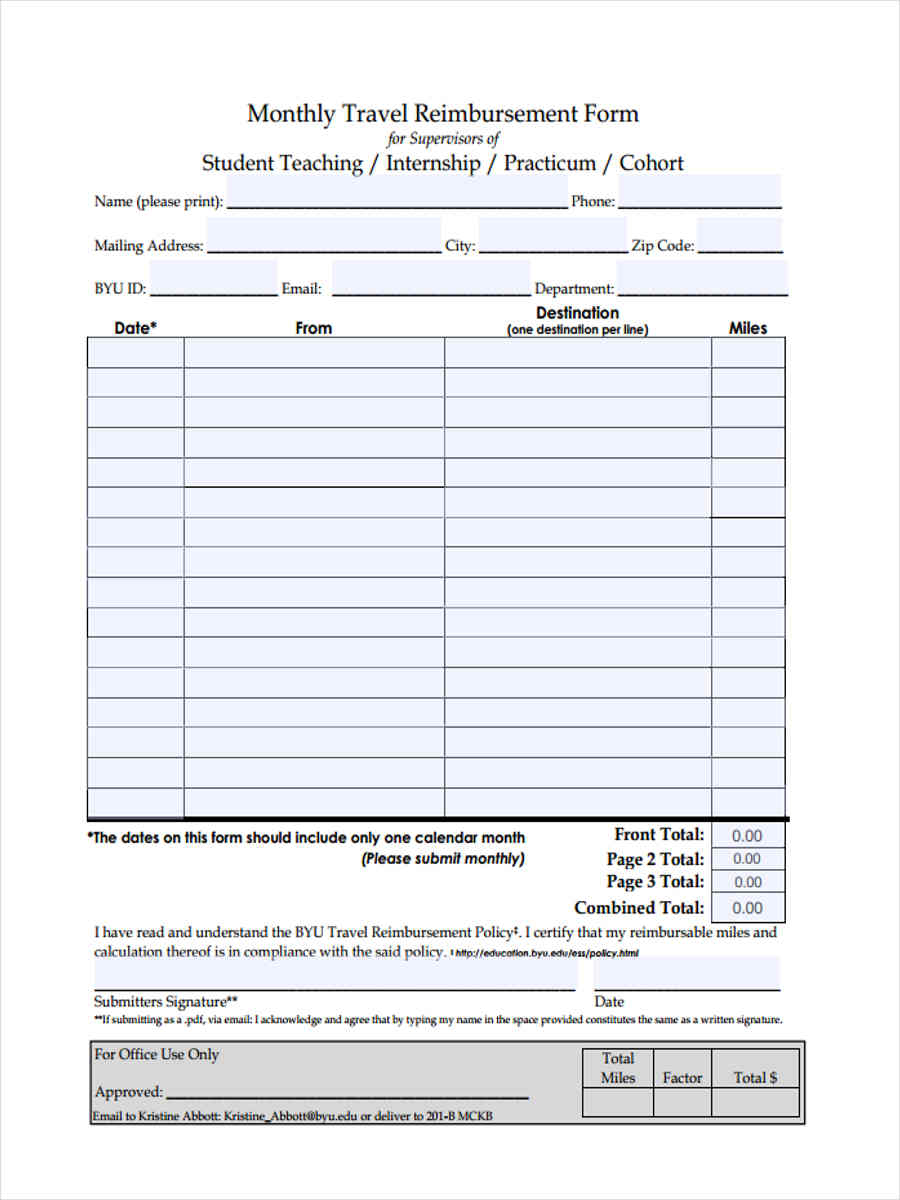

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, For 2023, the federal maximum rate is a flat 65.5 cents per mile. Effective july 1, 2022, the internal revenue service (irs) has established new mileage.

Source: aleeceqmelodie.pages.dev

Source: aleeceqmelodie.pages.dev

What Is The Mileage Rate For 2024 In Canada Zita Angelle, 67 cents per mile driven for business use. Any employee driving for work and using their own personal vehicle for work can claim 65.5.

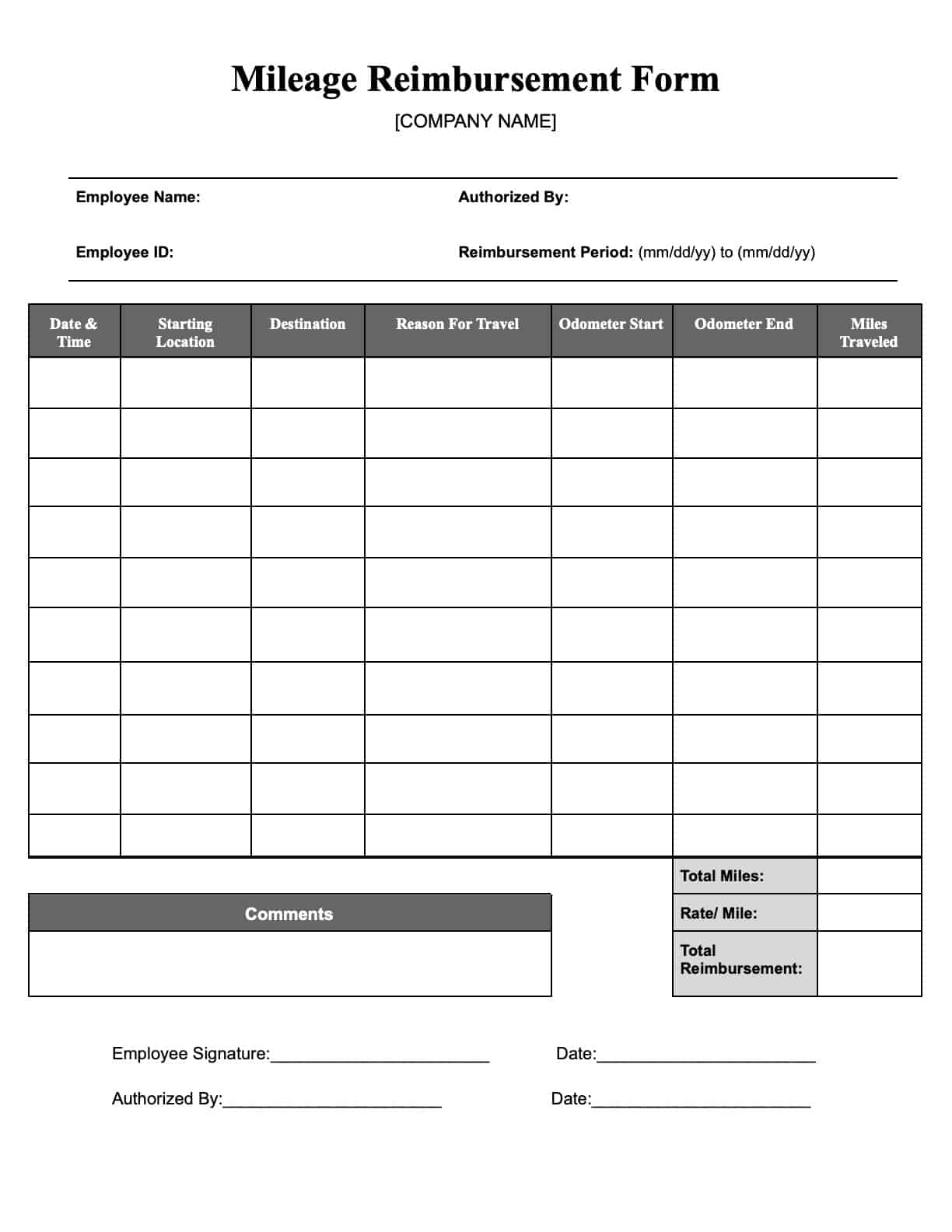

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Mileage Reimbursement Advantages, Laws, & More, The internal revenue service has increased the reimbursement rate for 2024 to 67 cents, up 1.5 cents from 2023, when using a personal vehicle for business. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023.

Source: eforms.com

Source: eforms.com

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, Beginning on january 1, the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable,. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Source: www.i-a-mileage-form.pdffiller.com

Source: www.i-a-mileage-form.pdffiller.com

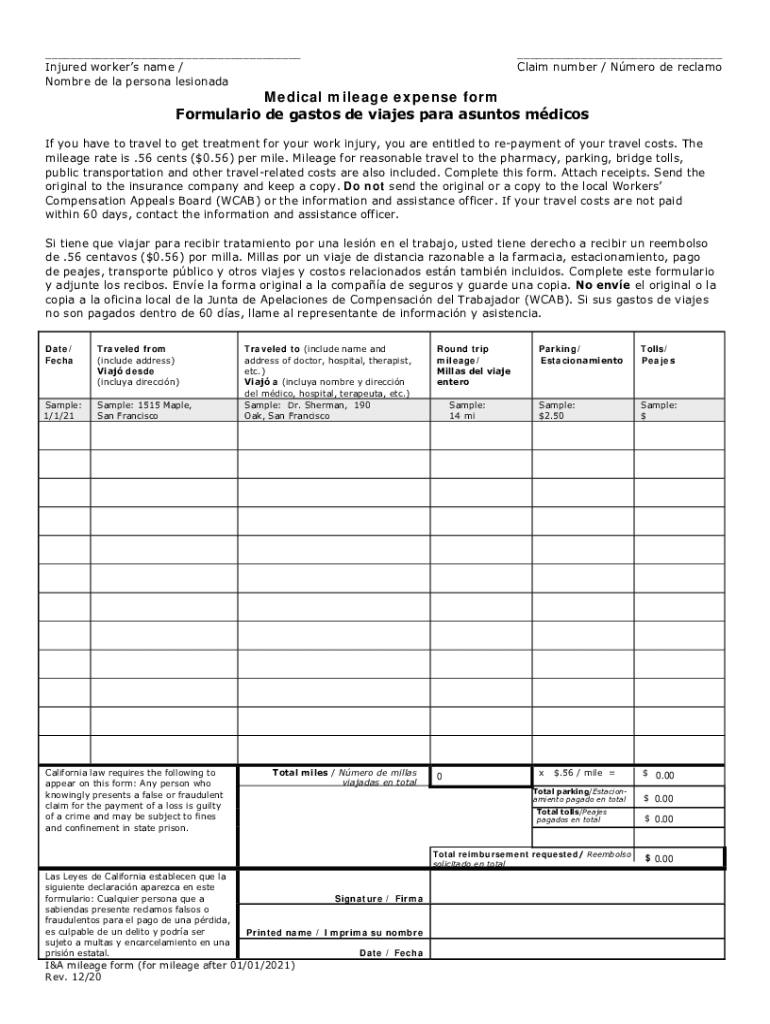

20202024 CA I&A mileage Form El formulario se puede rellenar en línea, Effective january 1, 2024, the office of state budget and management (osbm) increased the travel mileage reimbursement rate for official university business. Change in irs mileage rates effective january 1, 2022.

Beginning January 1, 2024, The Standard Mileage Rates For The Use Of A Car (Also Vans, Pickups, Or Panel Trucks) Will Be:

You may also be interested in.

For 2023, The Federal Maximum Rate Is A Flat 65.5 Cents Per Mile.

Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.