Max Federal Tax Rate 2024. This move is aimed at simplifying the tax filing process. Federal married (joint) filer tax tables.

Overview of federal income taxes. Written by derek silva, cepf®.

Federal Married (Joint) Filer Tax Tables.

In 2023 and 2024, there are seven federal income tax rates and brackets:

The Federal Standard Deduction For A Single Filer In 2024 Is $ 14,600.00.

As your income rises it can push you into a higher tax.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Federal estate tax rates max out at 40% for amounts higher than $1 million.

Source: www.forbes.com

Source: www.forbes.com

Taxing The Rich The Evolution Of America’s Marginal Tax Rate, See current federal tax brackets and rates based on your income and filing status. For example, let’s say your estate is valued at $14.05 million.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, The federal income tax has seven tax rates in 2024: We've got all the 2023 and 2024 capital gains tax rates in one place.

Source: perlaqsybille.pages.dev

Source: perlaqsybille.pages.dev

Taxes By State 2024 Dani Michaelina, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Taxable income and filing status determine which federal tax rates apply to.

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, Earning dividends is a great incentive for investing in certain. Updated on december 15, 2023.

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

What Are The Different Tax Brackets 2024 Eddi Nellie, Fact checked by patrick villanova, cepf®. For single filers in 2024, all income between $0 and $11,600 is subject to a 10% tax rate.

Source: atonce.com

Source: atonce.com

50 Shocking Facts Unveiling Federal Tax Rates in 2024, $3,500 x 0.22 = $770 federal tax withholding. For single filers in 2024, all income between $0 and $11,600 is subject to a 10% tax rate.

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

What Are The Different Tax Brackets 2024 Eddi Nellie, This compilation is intended to. In another example, jane receives a $1.3m bonus.

Source: www.businessinsider.in

Source: www.businessinsider.in

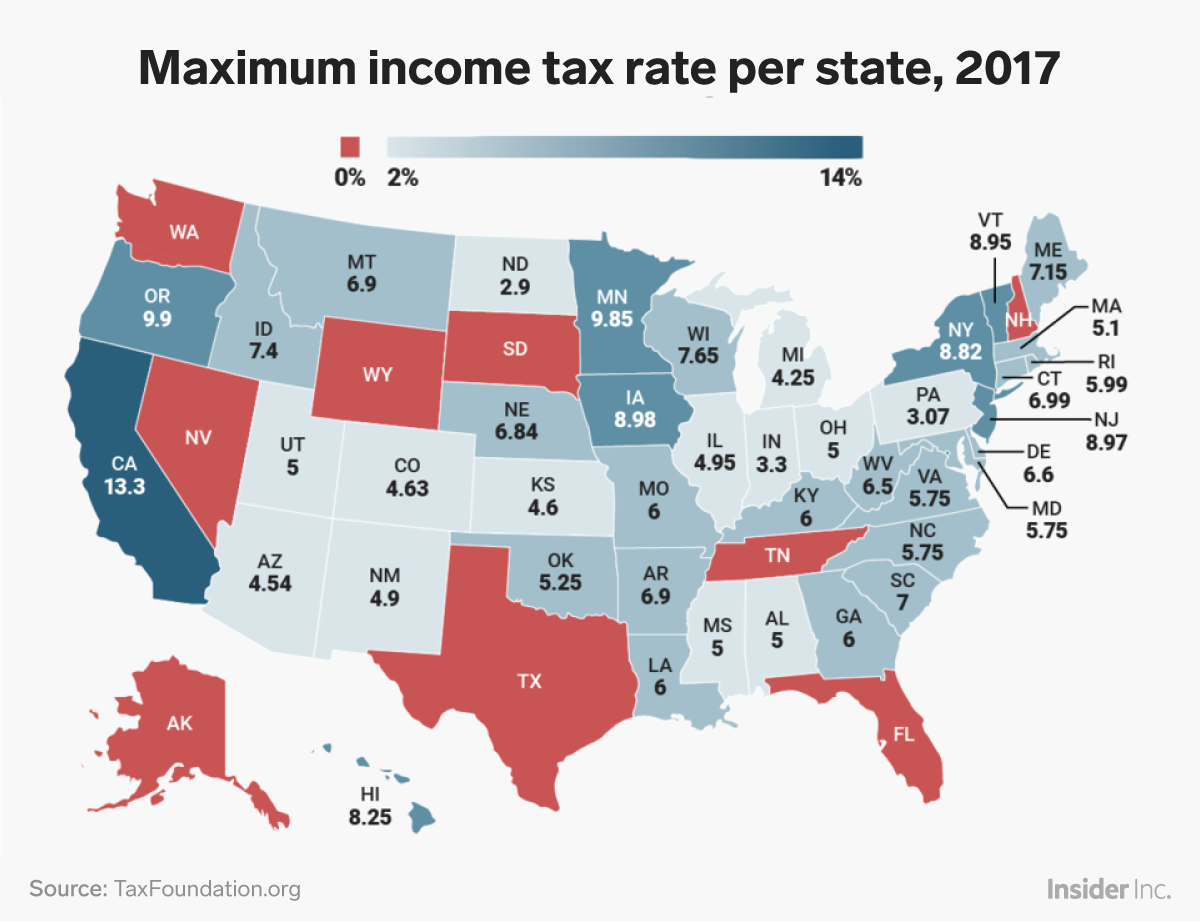

April 17 was Tax Day in the US. This map shows the tax rate per, Fact checked by patrick villanova, cepf®. The highest earners fall into the 37% range, while those who earn the least are in.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Tax Resource And Help Center The College Investor, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Up to $23,200 (was $22,000 for 2023) — 10%;.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

As Per Section 192A Tds Rate On Pf Withdrawal For Employees Without Pan Reduced To 20% From The Maximum Marginal Rate.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.